Fusion Lending - A new class of credit broker

We offer a full range of products from over 100 funders, meaning that when we work with you we can get you the best product, at the best possible rate. Our network of experts are ready to help you find the perfect solution

You don’t pay your staff 5 years in advance, so why pay for income producing assets in advance? They should be paid for from future revenue as they generate you income, preserving working capital for more productive purposes

Purchase the equipment that you need today and repay it off over a period that suits you, with terms up to 6 years

We offer both Hire Purchase and Leases for both new and used equipment; we can even refinance your existing equipment

Any type of asset can be funded whether it be new or used, tangible (hard) or intangible (soft)

If you need to raise funds for your business, then a business loan is the product for you

With unsecured business loans available for any legitimate business purpose, & with periods of between 3 months and 6 years, a business loan from Fusion Lending could help to fill the working capital gap left by your bank

Your business loan could be used for;

We can raise funds that are secured on a property, using the gap between the value and the mortgage. Repayments can be either short or long term.

Offer your patients or clients the ability to repay their treatment or services over a period of time that is affordable to them

Help your Patients fund any treatment from £1,000 to £50,000 at NO cost to your clinic

Our Patient Finance option has been designed to help your clinic close more business, and by helping your patients spread the cost of any treatment, this is now easier than ever.

Patient Finance has moved away from expensive subsidies and long application forms. By joining forces with a leading finance broker, your patients get access to over 90 lenders and can see if they could be accepted for finance without it showing on their credit report. The online application process is simple and almost anyone can apply.

Please either click the button below to book some time with one of us to discuss how this works in more depth.

If you sell equipment then we can help you by allowing you to offer finance to your clients. Remove that barrier to purchase

You can raise funds today and pay back nothing for a period of time that you choose, then pay back the loan and the interest in one repayment.

If you have clients that owe you money then we understand that this can put a strain on your cashflow & Fusion Lending can help by using this debtor list to raise finance

If you use a card machine then we can raise funds for you, the more you take the more we can raise, and repayments are taken back each month automatically.

If you are developing your property portfolio then we can help raise the funds to complete your projects quicker

If your business is dependent on critical people, what would happen if they were off work for an extended period of time?

A key person isn’t just a director/partner of the business but could be someone with key skills such as a scientist or a prolific sales-person whose death could cause financial hardship to the business. The business can be protected by taking out a life insurance policy on them.

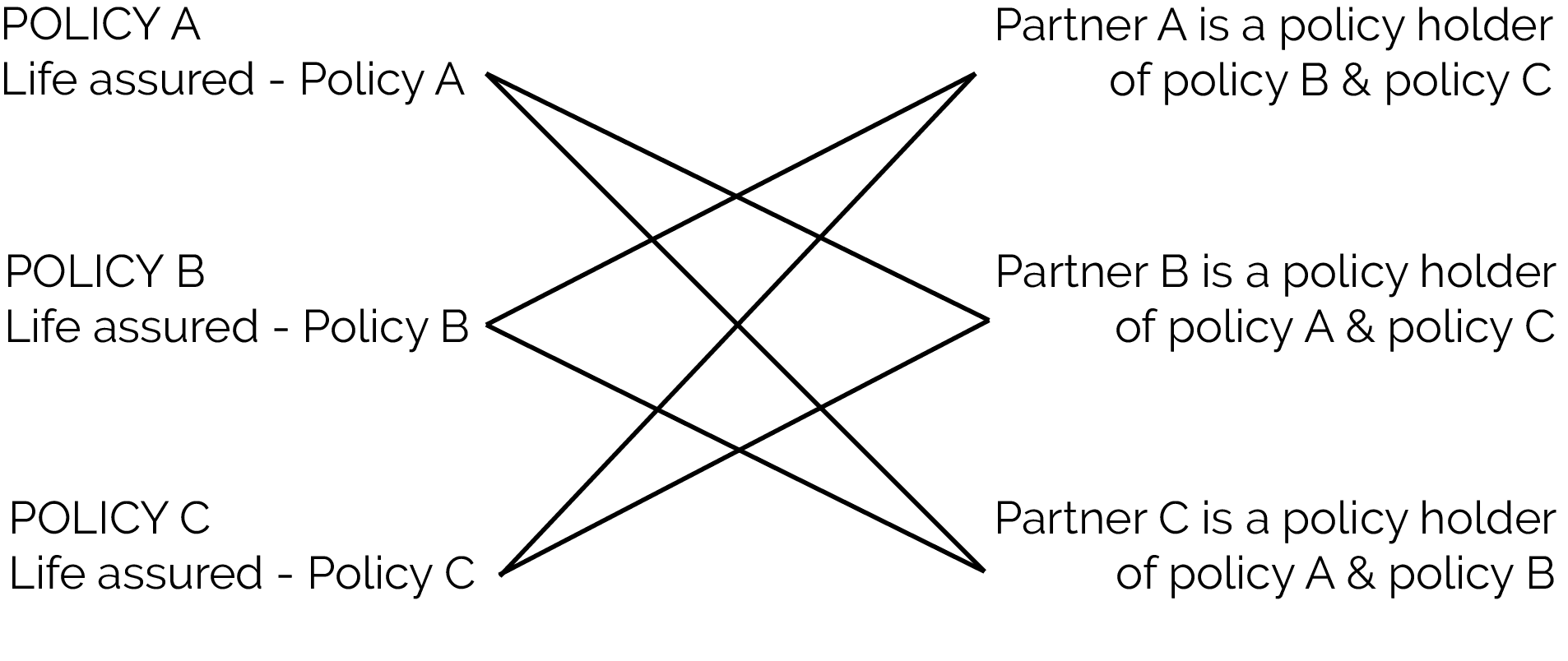

Protect your business from unwanted disputes in the event of the death of a partner or shareholder

Agreements & life policies can be put in place so that in the event of the death of a partner or shareholder there are funds available to acquire the shares & avoid disputes or unwanted relatives being involved

A "cross option" agreement can also be put in place in conjunction with life policies taken out on in other in trust

APPLY NOW

APPLY NOW